Share Margin Financing (PacMargin)

Share Margin Financing (PacMargin) is a credit facility offered by Inter-Pacific Securities Sdn Bhd for investors to finance the purchase of quoted securities on the Bursa Securities only, by pledging acceptable collateral with us.

This facility is suitable for active and sophisticated investors who intend to capitalise on market opportunities and to increase and diversify their investment portfolio.

The benefits of our PacMargin:

- Competitive margin financing terms.

- An avenue to leverage existing securities to purchase additional securities.

- Informative monthly statement of account.

Details on PacMargin

PacMargin is a share margin financing facility granted to IPS clients for the purpose of financing purchase of shares or securities listed on the Bursa Malaysia Berhad against a portfolio of collaterals.

PacMargin allows clients to leverage on shares or securities deposited and purchased in margin account to maximise and increase the level of investment opportunities.

If you are interested to explore our PacOnline trading, please click HERE.

- High Margin Of Financing

PacMargin finances up to 60% of the value of the and purchased securities listed on the Bursa Malaysia Berhad. - Multiply Your Investment Power

- Leverage up to a maximum of 1.5 times against pledged securities listed on Bursa Malaysia Berhad.

- Leverage up to a maximum of 2.5 times against cash collateral.

- Competitive interest rate

Competitive interest rate at * 10.5% p.a.

* The Company reserves the right to vary the interest rate at its sole and absolute discretion from time to time. - Interest income for credit balances

PacMargin pays interest for excess funds or credit balances exceeding RM5,000 placed under trust account for more than 30 days. - Online Trading Services – No Hassle & Fuss Free Transactions

You may monitor your portfolio and invest online with PacOnline, an internet-based online shares trading services at www.paconline.com.my that provide quality corporate financial information and research news that will enable investors to make better investment decisions at anytime and anywhere. - Instant Access To Account Inquiry

You may log on to PacOnline, our online trading services at www.paconline.com.my to inquire your daily position showing your trade transactions, collateral, outstanding balances, financed contracts, available credit limit, equity ratios and other essential information. - Comprehensive Statement Of Account

A daily Client Statement of Account would be given to your Dealer’s Representative/ Remisier to monitor your account position. In addition, a comprehensive monthly Margin Statement of Account will be sent to you to provide you with detailed information on the monthly financial transactions and account balances. - Custodian and Nominees Services

We provide custodian and nominees services and you will be informed on any developments with respect to the entitlements and corporate actions i.e. bonus, dividend payment, rights issue, general offer, warrants conversion etc. - Others

- No processing fees

- No commitment fees

- Subsidized stamp duty

- Cash / shares withdrawal facility

PacMargin finances up to 60% of the value of the purchased shares or securities listed on the Bursa Malaysia Berhad. Nonetheless, the company reserve the right to vary the margin of finance at its sole and absolute discretion from time to time.

To secure a share margin financing facility, a client is required to deposit collateral in the form of cash or shares or securities listed on the Bursa Malaysia Berhad or such other form of collateral that may be determined by the Company from time to time.

PacMargin allows you to leverage up to 150% against pledged shares or securities listed on the Bursa Malaysia Berhad or 250% against cash collateral.

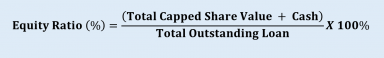

A client’s margin account or credit position is subject to share margin Equity Ratio or Equity/ Outstanding Ratio (ER). ER is derived from the total share value of the collateral pledged or shares purchased against the outstanding amount as stated: –

The ER shall not at any time be lower than the Approved Equity Ratio as set out in the Agreement.

When there is a sudden fall in the value of the shares or securities and the ER falls below the Approved Equity Ratio, margin call will be instituted. You are required to regularise the shortfall by depositing additional securities or alternatively, reduce the outstanding loan within (3) market days following the date of notice by the Company. Failing which, the Company shall have the right to liquidate any or all of the securities in the margin account.

Conversely, when the investor’s ER exceeds the Approved Ratio, the excess cash / shares can be withdrawn from the account, or more stock can be purchased without additional cash.

- Complete these forms.

To apply for PacMargin, you need to complete and return the following forms to us: –- Margin Facility Application Form (Individual or Corporate)

- Trading Account Application Form (Individual or Corporate)

- List Of Shares To Be Pledged As Collateral

- Online Trading Application Form (optional)

- Application for Direct Crediting Client Monies into Bank Account (Optional)

- eStatement – Request for Electronic Statements (Optional)

- Declaration BNM Exchange Administration Policy Form

- RM10 for the opening of CDS Account in the name of Inter-Pacific Securities Sdn Bhd.

-

- These forms are available here.

You may obtain the above forms as follow: –- Download from the Web page (Please click here for Application Forms)

- Call our customer service centre at 03-2117 1888 and request the forms to be sent by mail / hand

- Visit us at our office in Kuala Lumpur or our branches in Penang, Johor Bahru, Danau Desa or Sri Petaling.

- Appoint a Dealer’s Representative/Remisier ( for New Clients Only)

For new clients, you are requested to appoint a Dealer’s Representative/ Remisier.

- These forms are available here.

To submit your application together with these Documents

You are required to submit the following documents:

For individual client

-

-

-

-

- NRIC, Passport (for foreigner)or Authority Card (for armed forces/police)

- Latest salary slips/ bank statements/ Form J/ EA Form/ Form B

-

-

-

For corporate/institutional client

-

-

-

- Board of Director Resolution authorising The Opening Of Margin Account

- Board Of Director Resolution authorising The Opening Of CDS Account

- Memorandum & Articles of Association or Constitution

- Form 8/9 – Certificate of Incorporation or equivalent document

- Form 13 – Certificate of Incorporation on Change of Name or equivalent document

- Form 24 – Return of allotment of shares or equivalent document

- Form 44 -Notice of Situation of registered office or equivalent document

- Form 49 – Return giving particulars in register of directors or equivalent document

- Latest Annual Return of the Company

- Director’s Personal Guarantee (each director/ authorised signatory)

- A copy of NRIC of director/ Authorised Signatories (both Sides)

- Latest audited accounts/ financial statement (2 financial years)

- Latest 3 months balance sheet and profit & loss account (for newly incorporated company only)

- Certified true copies of Bank Statement as eServices supporting documents

-

-

-

-

- Stamp Duty

Stamp duty payable for Margin Financing Agreement executed is 0.5% of the facility limit. However, we will subsidise your stamp duty for facility limit application of not more than RM 450,000 as follows:- Subsidy of RM 400 or 80% of the stamp duty for facilities approved up to RM100,000.

- Subsidy range from RM375 to RM1,125 or 50% of the stamp duty for facilities of RM150, 000 to RM450, 000.

Note: No subsidy for stamp duty for facilities of RM500,000 and above.

- Other Fees

Other fees payable are:- RM10 for the opening of a CDS Nominees Account.

- RM45.00 for registration of the Power of Attorney with High Court

- Fee for attestation of the Power of Attorney (actual as per lawyer’s bill, or waived if using our panel lawyer).

- Stamp Duty

-

-

-

- Margin Facility Limit

- Minimum limit of RM50,000

- Maximum limit of RM1,000,000 (limit exceeding RM1,000,000 is subject to client’s track record and credit rating)

- Security/ Collateral

- Cash deposit and / or marketable shares or securities listed on the Bursa Malaysia Berhad.

- Non-marginable counters (securities that are considered high risk) will be accorded zero value although they can be accepted as collateral.

- Exposure to a single counter must not exceed 33% of the total share value.

- Margin Financing Rate

The Margin Financing Rate * are as follows: –Effective Margin Rate Shedding Max Capping Main Board Counters 85% 15% RM 15.00 Main Board Counters

(Previously known as Second Board Counters)80% 20% RM 4.00 TSRs / Warrants / Loan Stocks 50% 50% RM 2.00 Mesdaq Counters 50% 50% RM 0.30 - Interest Rate

- The interest rate for margin facility is 10.5% * p.a., chargeable on monthly basis.

- Default interest at the rate of 3%* above the current interest rate will be charged on the defaulted monthly interest.

- Rollover Fee

A rollover fee of 1.0%* flat will be charged on outstanding purchases on every 90 days. - Withdrawal Of Shares / Cash

- Notice to withdraw shares / cash must be given at least 2 market days in advance.

- The approval of withdrawal of shares or cash is subject to the equity in the margin account does not fall below the Approved Equity Ratio.

- Withdrawal Fee of RM20.00 per counter or up to a maximum of RM500 will be charged for withdrawal of shares.

- Margin Facility Limit

-

-

-

- Who are not eligible to open a PacMargin Account with our Company?

- A person below the age of 18 years.

- An employee and/or Director of other Participating Organisations

- A person listed as defaulter by Bursa Malaysia Berhad under Rule 403.1 of the rules relating of Bursa Malaysia Securities Berhad.

- An undischarged Bankrupt.

- A person suffers from mental disorder.

- A person with adverse credit and/or criminal record.

- All other persons referred to in Rule 703.6 of the rules of Bursa Malaysia Securities Berhad.

- How long does it take to approve a PacMargin application?

All applications would be approved within 3 market days if criteria were met. - Can a foreigner apply for PacMargin?

Yes. - What is the repayment schedule?

There is no fixed repayment as long as your account position meets our margin requirements. - What will happen to the shares I pledged?

A CDS Nominees account will be opened. All the shares pledged and financed will be registered under the name of Inter-Pacific Equity Nominees (Tempatan / Asing) Sdn Bhd with you as registered beneficial owner.

- Who are not eligible to open a PacMargin Account with our Company?

-

| Title | Download |

|---|---|

| Trading Account/ Margin Facility Application Form (Individual) | Download |

| Margin Facility Application Form (Corporate) | Download |

| Trading Account Application Form (Corporate) | Download |

| FATCA & CRS Self Certification Form (Corporate) | Download |

| FATCA & CRS Self Certification Form (Controlling Person) | Download |

| List of Shares To be Pledged As Collateral | Download |

| Online Trading Application Form (Optional) | Download |

| Application for Direct Crediting Client Monies into Bank Account (Optional) | Download |

| eStatement – Request for Electronic Statements (Optional) | Download |

| Declaration BNM Exchange Administration Policy Form | Download |

| Bursa CDS Form | Download |

Note: The company reserves the right to vary the above terms and conditions at its sole and absolute discretion from time to time without prior notice.